One of the reasons that digital technologies stay interesting is their ability to advance and change. Energy storage definitely fits that category. It started out very simply, it stored electricity, but it soon became evident it could do a lot more. One of the most popular branches of the technologies are the behind-the-meter (BTM) applications. The consumers loved them, and so do utilities and regulators. With prices dropping, power outages increasing, and government inducements, it’s likely the trend will continue.

As exciting as the BTM market is, utilities and grid operators have also been causing quite a stir on their side of the meter with energy storage systems. The one getting the majority of the attention is utility-scale battery energy storage systems (BESS). The application has been around for over a decade, but it has been evolving to the point it’s a key role in modernizing the power delivery system.

Li-ion Leads the Way

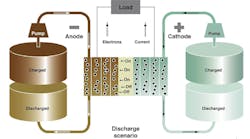

The technology is proving to be a valuable multifaceted tool in transformation of the power sector. Supporters have said modern BESS applications are recharging the technology. According to NREL (National Renewable Energy Laboratory) BESS technology can enhance a power systems’ flexibility. They use a variety of battery chemistries such as lithium-ion (Li-ion), redox flow, lead-acid and molten salt. But it has been Li-ion technology that is leading other chemistries when it comes to utility-scale BESS devices in the marketplace.

Before moving on, it would be a good idea to define what is meant by utility-scale. There have been several terms used interchangeably such as utility-scale, large-scale, long duration, etc. and it can be confusing. Let’s stick with utility-scale. Utility-scale keeps it clear which side of the meter is being discussed, but what is meant by utility-scale? Keeping it simple, a battery is all about rated power and energy capacity.

A utility-scale BESS typically has a rated power in the range of a few megawatts (MW) to hundreds of MW. It’s energy capacity usually falls in a range of several megawatt-hours (MWh) to hundreds of MWh. There are several other significant characteristics like storage duration, cycle life, round-trip efficiency, etc. that are important when specifying the device, and they add greatly to the complexity of the subject.

Recharging Energy Storage

For this discussion, MW and MWh are the important quantities needed to understand the technologies and their projects. Also, these are the most common terms used in the announcements concerning new utility-scale BESS installations. The key takeaway here is utility-scale BESSs are becoming the go-to energy storage technology for the power grid. The EIA (U.S. Energy Information Administration) July 2022 monthly electricity report has the statistics supporting this.

The report stated that in the U.S., the installed utility-scale BESS rated capacity has tripled from 2020 to 2021. EIA provided more details saying the actual figures went from 1,438 MW in 2020 to 4,631 MW in 2021. Continuing, “The increase was driven by the addition of 106 utility-scale BESS with 3,202 MW of capacity that went into commercial operation. It’s interesting to note that EIA placed a caveat on its utility-scale designation as being “equal to or greater than 1 MW.” About 78% of the battery storage capacity added in 2021 was built in regional transmission organization (RTOs) service territories.”

EIA’s report provided insights on the forces driving BESS deployment and they are as interesting as the technologies associated with BESS devices. Operators reported more applications went beyond the traditional ancillary services such as frequency response, ramping and spinning reserve, arbitrage, etc. According to EIA those services still represent a significant share, but arbitrage, load management, and response to excess wind and solar are becoming more important to the power grid.

Interestingly EIA said that arbitrage (time shifting) alone was cited for over 50% of the BESS capacity installed. Furthermore, about 83% (1,887 MW) of the battery capacity added in the California Independent System Operator (CAISO) service territory was for arbitrage. In other words, they charge the BESS when demand is low and discharge when demand is high. It’s also an important tool when it comes to demand management and flattening the demand profile. It gets a little unclear when it comes to global driving forces associated with utility-scale BESS devices.

It appears that most of the estimated projections are based on the entire BESS marketplace, which is understandable considering BESS devices cover such a wide range of applications. Research and Markets, the research company, published their “Battery Energy Storage Systems – Global Market Trajectory & Analytics” report a few months ago. The report said that the global BESS market size is expected to grow from US$ 4.7 billion in 2022 to approximately US$ 12.9 billion by 2026, at a CAGR (compound annual growth rate) of 26.1% over the analysis period. Some of the major suppliers are GE, Hitachi, Siemens, Tesla, and others.

On the Grid

Late last year, Florida Power & Light (FPL) commissioned its Manatee Energy Storage Center in Parrish, Florida. FPL calls its utility-scale Li-ion 409 MW/900 MWh BESS the world’s solar-powered battery. The BESS charges during the day with extra solar energy produced by the solar array at the 74.5 MW Manatee Solar Energy Center and supplies solar generated electricity after the sun sets.

Recently, Inergex Renewable Energy Inc., an independent renewable power producer, said that Mitsubishi Power had been awarded an order for two utility-scale BESS projects in the Atacama of Northern Chile. These projects will be located at two existing solar photovoltaic (PV) facilities. One BESS will be located at Inergex’s 68 MW Salvador PV and is rated 50 MW/250 MWh. The other BESS will be located at Inergex’s 50.6 MW San Andres PV facility and is rated 35 MW/175 MWh. These BESS projects will enable the PV facilities to shift the solar generated electricity to the hours after the sun sets when there is greater need.

A few months ago, Dalian Rongke Power announced the connection of their 100 MW/400 MWh vanadium redox flow battery to the grid in Dalian, China. The second phase of the project will push the full capacity of the battery to 200 MW/800 MWh. The utility-scale BESS will perform peak shaving and “valley-filling” grid auxiliary services to offset the variability of the city’s solar and wind energy supply.

Southern California Edison (SCE) awarded a contract to Ameresco Inc for three utility-scale BESS projects last year. The projects are located at three distribution substations in SCE’s service territory to provide for the electricity demands in the San Joaquin Valley, Rancho Cucamonga, and the Long Beach area. The system equates to 537.5 MW/2,150 MWh. SCE’s spokesperson said the three substation systems are a novel approach for incorporating advanced energy storage at the distribution level. The three BESS projects are expected to be in service by the end of 2022.

Scottish and Southern Energy (SSE) announced the technical group Wärtsilä would provide a utility-scale BESS project located in Salisbury UK. The BESS is rated 50 MW/100 MWh. It will be the first connected directly to the transmission network by SSE’s solar and battery division. It will support clean reliable energy by balancing the intermittency of renewables and is expected to be in service by September 2023.

Utility-Scale Benefits

With all the features being offered by utility-scale BESS technologies, it’s easy to see why they’re setting records for installations. It also helps that there’s a great deal of regulatory support. Regulators worldwide are backing energy storage with new policies, guidelines, directives, and regulations. This support is designed to strengthen the power grid and encourage utilization of energy storage throughout the grid, and it’s working.

The versatility of utility-scale BESS devices are affecting every aspect of the power delivery value chain with utility-scale benefits. These BESS devices are providing utilities with valuable ancillary services, the ability to increase renewable resource integration and the support for the transition from fossil-fuel powered generation to non-carbon renewable generation.

Grid operators are seeing a more efficient balance between supply and demand, avoided system upgrades and improved reliability. It also helps that while the technology has been improving and evolving, the costs have been dropping significantly. In other words, the owners and operators are getting more bang for their buck as the old saying goes.

The technology is readily available and it’s getting better all the time, not to mention it’s shaking up the industry a bit. Thinking back, utility-scale BESS technology started out in the form of small pilot projects to see how it would affect the gird. In a little over ten years, it has become a critical element in the goal of modernizing the power grid.

There is a lot of speculation what energy storage will be like in the next 10 years, but you can bet there are some really cool developments on the horizon. It’s going to be interesting seeing what develops with the next-gen utility-scale BESSs, and it will be exciting!