Regulators Surprise Dominion With Offshore Wind Performance Guarantee Clause

Virginia regulators have approved Dominion Energy Corp.’s plans for a 2.6-gigawatt wind farm off the coast of Virginia Beach but are pushing for a performance requirement the company’s leader calls “an unprecedented layer of financial one-way risk.”

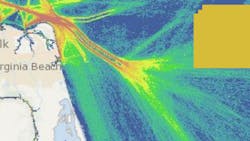

Dominion plans to spend $9.8 billion to build the Coastal Virginia Offshore Wind, which will span nearly 180 turbines sited on 113,000 acres more than 20 miles from Virginia’s coast. The project is expected to be completed by late 2026 and will generate enough energy to power up to 660,000 homes.

In giving its approval for construction last week, the Virginia State Corporation Commission said the project will help meet the state’s projected energy needs but added that it wants to cap the possible exposure of customers to costs beyond those being contemplated today. To that end, the commission said, Dominion should be responsible for extra spending if the wind farm’s net capacity factor fall s below an average of 42% over a three-year period. (Read the decision here.) In choosing that number, the body noted that the Dominion team had used it in its cost-benefit analysis and other projections.

Speaking on an Aug. 8 conference call with analysts and investors after Dominion had reported second-quarter results, Chairman, President and CEO Bob Blue said his team is “extremely disappointed” in the performance requirement and said the company will consider an appeal or other measures once it has explored the decision, which he called untenable, in more detail and conferred with other stakeholders in the project.

“Effectively, such guarantee would require [Dominion Energy Virginia] to financially guarantee the weather, among other factors beyond its control, for the life of the project,” Blue said.

Blue said the State Corporation Commission is contradicting its decision on another Dominion clean-energy plan from last year, when it said involuntary performance guarantees aren’t needed for, as Blue put it, “projects specifically contemplated within the framework of the [Virginia Clean Economy Act] and needed by law to meet the objectives and requirements therein. By applying the commission's own logic, the same outcome should be made here.”

Asked on the conference call about Dominion’s use earlier in the application process of a 37% net capacity factor, Blue suggested that there is room to work out a compromise that gives both Dominion and its customers some protection.

“That space in between, I think, is precisely where we would be looking to try to find common ground,” he said.

In the three months ended June 30, Dominion posted a net loss of $453 million that included one-time items related to the sale of its retired nuclear power station in Wisconsin, some hedging activities and other accounting changes. Operating earnings rose about 5% to $658 million, with bottom-line growth at the company’s operations in South Carolina and its gas distribution unit offsetting a drop in profits from contracted assets.

Also discussed on Dominion’s call Aug. 8 was the proliferation of data centers in Northern Virginia and Dominion’s work to meet future growth in that sector, which today accounts for about a fifth of Dominion’s total sales in Virginia. With data center demand forecasts having been ratcheted up recently, Blue said his team is accelerating its plans “by several years” for new transmission and substation infrastructure in part of Loudoun County, west of Washington, D.C.

“To be clear, we're not at the limits of our facilities today,” Blue said, noting that the projects will include two 500 kV transmission lines. “But we need to act now to alleviate transmission constraints in the future while serving our customers’ growth in this region.”

Shares of Dominion (Ticker: D) fell more than 1% Aug. 8 but recovered that ground the following day and were changing hands around $82.80. Over the past six months, they have risen slightly, growing the company’s market capitalization to about $69 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications T&D World, Healthcare Innovation, IndustryWeek, FleetOwner and Oil & Gas Journal. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.