A Confluence of Factors Exposing Industry Investment Gaps

According to its Failure to Act report released in early September, the American Civil Society of Engineers (ASCE) is predicting a $338 billion gap in electric infrastructure investment by 2039. That gap, representing shortfalls in spending for generation and T&D, is driven by a confluence of factors — the changing energy mix, new markets, resource adequacy, and the increasing volume and severity of climate-related events that is expected to worsen in coming years.

If investment needs are unmet, the United States will be faced with a series of “interrelated consequences” arousing from the lack of reliable power, says ASCE. For example, household costs could rise from $13 per household per year in 2020 to $563 in 2039. With production impacted, businesses are forecasted to lose $271 billion in the value of exports, while consumers incur an additional $142 billion in foreign imports during that same timeframe.

Spending in T&D Has Grown — But Not Enough

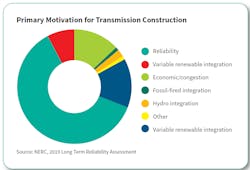

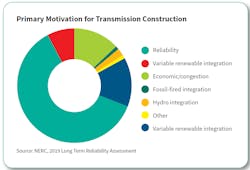

Investments in transmission infrastructure have grown in recent years, from $15.6 billion in 2012 to $22.2 billion in 2018, and increased spending is projected to 2022. At 11% of the 2039 investment gap ($39 billion), the forecasted leveling off after 2022 is troubling, given an Energy Information Association (EIA) recorded that the percent of transmission outages caused by unexpected failures grew from 32% between 2014-2018 to 46% in 2019 (based on voluntarily provided data cited in the report). That uptick is thought to be associated with a large number of wildfire events in 2019. As I write this, 2020 wildfires in California have already surpassed 2019 (and all previous years recorded) in terms of the number of events and acres of land burned. Once costs to utilities and then secondary costs to consumers are calculated, I have no doubt that will also surpass those of recent years.

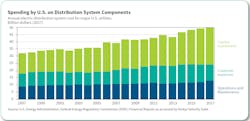

Perhaps a more troubling finding is the forecasted investment gap in distribution-level infrastructure, 29% of the 2039 estimate ($100 billion). Since 2008, investment in distribution networks has increased dramatically, up 54% over the past two decades, according to EIA data cited. But, the distribution grid is significantly more exposed to factors such as aging infrastructure, adoption of distributed renewable resources, rising customer demands, and of course, climate-induced challenges.

Where are the Investments?

Utilities are investing in equipment and new technology, including smart grid investments and information systems that provide better information and general service options for customers.

Not surprisingly, the oldest grids have seen the most investment according to FERC financial data cited in the report, but many of these are located in regions that are responsible for the largest investment gaps in the forecast period: California, Northeast, Mid-Atlantic. These are among the most susceptible regions in the near term to climate change with exposure to coastal storms, rising sea levels, high temperatures and wildfire. Those factors may make it near impossible for utilities to keep up.

Of all these areas, some might argue that insufficient investment in physical and cybersecurity may be the greatest threat to the reliability of the power sector. Going mostly unseen by the public, experts report that the quantity and sophistication of attacks on the power industry have been rising at an alarming rate.

Recently, Sean Stalzer, director of Cybersecurity at Dominion Energy, reported that his organization currently deals with approximately 3 billion attacks per month, and that number will only grow. He also believes that Dominion is not terribly unique in this respect. As a result, it has invested in and implemented a robust program to address physical and cybersecurity in a holistic, focused manner across its generation and T&D asset base and workforce. However, Dominion is only one of a small number of leaders in this approach.

“In North America, there continues to be a disproportionate focus on compliance rather than embracing holistic, risk-based security practices,” says Michael Kelly, a senior research analyst at Guidehouse Research. According to Kelly, this results in a significant spending gap between compliance costs and necessary security measures, while the bulk of the distribution system sits outside of NERC CIP compliance.

Without a lot of firm industry data it is difficult to do more than speculate on how security investment gaps would compare to other shortfalls on infrastructure spending — but I would personally bet that they are significant today, and will only continue to be more significant in the future.