Economists at The Brattle Group recently released an updated assessment on the ongoing impacts and implications of COVID-19 on the electric utility industry and related energy sectors. The assessment shows U.S. regulated electricity companies experienced relatively modest revenue and earnings impacts through the summer in spite of demand decreases, but dark clouds may be appearing on the horizon.

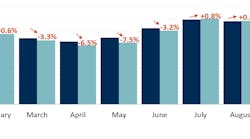

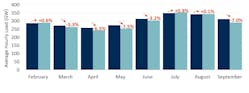

Impacts have been mitigated so far by public funding for income replacement and moratoria on payment of utility bills, rent, and loans. However, many of these customer protection programs are declining at the same time as a widespread surge of COVID-19 cases is occurring in the United States. Electricity demand is dipping again, as it did in April and May — electric loads across many of the U.S. ISOs declined by an average of 7% in September 2020 compared to the prior four years, with the largest reductions occurring in PJM and MISO.

The authors of the assessment note that gas utilities have not seen much demand impact from COVID-19 so far, perhaps because of the pandemic occurring in spring and summer, periods that typically have lower demand. Electric utilities have had both load and revenue reductions but nonetheless managed to improve earnings in Q2 because of cost management that may not be sustainable. Thus, there is a material risk (despite favorable GDP forecasts) that the policy landscape surrounding cost recovery mechanisms and shut-off moratoria will be severely challenged if commercial and personal defaults rise from growing COVID-19 cases this winter, prolonging the economic slowdown.

Other key findings of the Brattle assessment include the following:

- Oil prices are holding steady near US$40/bbl (spot) — about US$20 below pre-pandemic levels, as uncertainty about the pace of economic recovery persists. Transportation fuel, a significant source of oil demand, remains below pre-COVID-19 levels. For example, global airline traffic is expected to decline by 66% in 2020 versus 2019.

- Fall U.S. natural gas storage inventories are near record highs, but lower production capacity combined with growing LNG export demand have put upward pressure on gas futures — January 2021 Henry Hub futures are at US$3.27/Dth, up 13% (US$0.37/Dth) since July.

- COVID-19 utility service disconnection moratoria were expected to expire in 20 states by the end of October 2020. However, many states appear likely to extend moratoria with a pre-set expiration date.

- Utility stocks' price growth has trailed the S&P 500, with utilities remaining relatively stagnant throughout the summer versus S&P 500's growth of 10%.

- Electric utility four-month daily betas declined by about 30% since the end of May, reaching 0.74, on average, falling back to near pre-COVID-19 levels.

Impacts and Implications of COVID-19 for the Energy Industry: Assessment through Mid-October 2020 is authored by Brattle Principals Frank Graves and Robert Mudge, Associate Josh Figueroa, Consultant Lily Mwalenga, Senior Research Analysts Tess Counts and Katie Mansur, and Research Analyst Shivangi Pant.