For more than a century, electric utilities have enjoyed regulated monopoly status. Disrupting this well-established business environment now are renewable energy technologies, digital intelligence and sensors, third-party market competition, environmental concerns and related government regulations.

With state regulators launching distributed energy resource (DER) mandates and market-restructuring initiatives from coast to coast, how are electric utilities responding to the challenge, and what factors are driving current and future distribution grid investment and development strategies?

Past, Present and Future

Regulators in New York, California, Illinois and Hawaii are actively pursuing major efforts to localize and animate new distributed electricity market structures. Though still in the early stages of development, these statewide initiatives require utilities to defer traditional generation and T&D investment in favor of bringing locally sited, IEEE 1547-compliant distributed generation and storage onto their networks. The goal is to transform the traditional utility structure into distribution service platform providers, load management utilities and utilities of the future. The stresses and strains this transition puts on the traditional utility business model is being felt globally.

By comparison, in the 1990s, the Internet exploded onto the world stage, dramatically transforming the face of communications and information delivery. Here in the early 21st century, the same digital revolution has expanded from computer networks to the electric grid. The “Energy Internet,” as it is known, is the new Wild West of innovation, transforming the way electricity is generated, transmitted, distributed, monitored and marketed.

Driving these developments are regulatory, technical and, certainly not least, environmental factors. When Superstorm Sandy devastated sections of New York in October 2012, scores were killed, electric outages were rampant and economic losses topped $52 billion. The wake-up call for grid modernization to public officials and industry stakeholders was undeniable.

Asked this past summer if utilities are in favor of the tsunami of DERs flooding onto their grids, New York Public Service Commissioner Gregg Sayre replied, “Yes, we don’t want to be w-a-c-o: wires and cables only.” Hence the push to move utilities into a new paradigm of operation.

Across the continent in California, record drought and wildfires are forcing policymakers and utility industry executives to rethink how to re-engineer, replace or offset the need for aging electric infrastructure, dependent as it is on water-hungry, carbon-emitting fossil-fuel power plants. The recent passage of California Assembly Bill 327 laid the groundwork for overhauling the traditional utility structure.

With billions in capital expenditures and associated financing obligations already on the books committed to maintaining the centralized electric grid infrastructure, California utilities now face regulatory, technical and market pressures to finance and deploy new decentralized, digitally based, multi-directional DERs and energy management systems.

DER Benefits

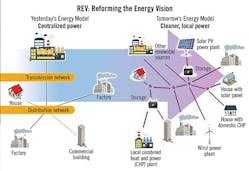

DERs comprise solar, wind, geothermal, energy storage, electric vehicle and microgrid technologies. Related energy management systems include distribution automation, demand response, and software-based home and building energy management systems. These technologies will force an overhaul of rate structures and transform the pricing and sale of electricity and services. The graphic illustrates possible distributed energy resource grid configurations.

The dramatic regulatory and market activity now underway in New York, California, Illinois and Hawaii suggests distributed energy is the wave of the utility future. DERs offer the utility numerous potential benefits:

- Deferred capital expenditures

- New revenue streams from platform-based services

- Advanced fault detection and outage restoration, reducing revenue loss from outages

- Volt/VAR optimization for line loss reduction

- Sale of energy-related services to customers

- A share in third-party revenues

- Associated state incentives.

New York’s Reforming the Energy Vision

Launched in 2014 by the New York Public Service Commission (PSC), in conjunction with the New York State Energy Research and Development Authority, the statewide Reforming the Energy Vision (REV) initiative aims to restructure the electric utility distribution network and create competitive energy marketplaces at the grid edge.

Among many of the proposed provisions, REV proceedings ask utilities to relinquish control and ownership of portions of their distribution networks and, instead, become load management utility platform providers on which third-party vendors and end customers will engage in transactive energy markets. In response to this prospect of cannibalizing themselves, many electric utilities are re-evaluating investment strategies in their distribution systems.

From the utility perspective, REV presents both challenges and opportunities. Utilities are being asked to restructure their distribution networks to include renewable energy, which cuts into traditional revenue streams while, at the same time, relinquishing ownership and control of key components of their distribution network to third-party energy providers.

“There are a lot of moving parts, a lot of coordination required and an interesting management challenge to distributed energy resource integration,” said Bob McGee, media relations spokesman for Con Edison of New York (Con Ed).

As of fall 2015, utilities are in the process of formulating distribution service implementation plans (DSIPs), which are due to the New York PSC by December 2015. DSIPs lay out how utilities can defer portions of the $30 billion statewide capital investments in transmission and distribution upgrades by incorporating DER technologies into their network portfolios.

As REV proceedings and working groups continue, with occasionally contentious discussion among competing stakeholders on new grid configurations and market models due in 2016, a real-world example of proactive utility DER integration can be found in the Long Island Community Microgrid Project (LICMP).

PSEG Long Island and the Long Island Power Authority, in partnership with the Clean Coalition, are in the process of installing approximately 15 MW of locally sited solar with a 5-MW/25-MWh battery backup system. The system configuration also will include advanced smart direct-current/alternating-current inverters. In addition to supplying on-site prioritized load management services and emergency backup power to key facilities in the event of another Superstorm Sandy, the system will provide volt/VAR regulation and optimization to the grid operator, reducing line loss.

In anticipation of the REV requirement to offset fossil-fuel-based generation with distributed energy, LICMP is intended to enable PSEG and Long Island Power Authority to defer construction of a 100-MW oil-based peaking plant. Rather than viewing DERs as competition, the involved utilities see distributed energy as a means of saving on capital expenditures because it localizes generation close to the load, eliminating transmission costs.

The LICMP is applying an analysis, design and deployment methodology developed by Clean Coalition that builds on existing grid infrastructure, reducing the possibility of stranded utility assets.

Meanwhile, Con Ed received approval from the New York PSC to defer a $1 billion substation upgrade in favor of pursuing $500 million investments in the utility’s Brooklyn Queens Demand Management (BQDM) program, microgrids, battery storage and smaller-scale substation upgrades. DER-related projects such as the BQDM are designed to bring load relief to Con Ed, allowing it to save on new generation and transmission costs.

Adding momentum to DER integration in New York are seven New York REV demonstration projects announced in August 2015. “Some like to pit the environment against the economy as if it’s one or the other,” Richard Kauffman, chairman of energy and finance for the state of New York, stated in a press release. “These demonstration projects provide another illustration of how New York is proving that premise wrong through innovative new business models that reduce carbon emissions by animating private investment in clean energy.”

These projects illustrate how New York utilities, in collaboration with third-party vendors and customers, are experimenting with distributed energy configurations to diversify their portfolios, increase grid reliability and reduce expenditures while complying with state regulations.

California’s Distribution Resource Plan

In response to California Assembly Bill No. 327 requiring the state’s three investor-owned electric utilities to submit a Distribution Resource Plan by July 2015, Southern California Edison (SCE) submitted a vigorous, highly detailed 467-page DER plan that includes three California Public Utilities Commission-mandated 10-year DER growth scenarios. SCE’s plan also proposes an integration capacity analysis study of SCE’s approximately 4,200 feeder circuits to determine optimal sites for DER construction and integration.

Russ Ragsdale, strategic planning manager and electric system planning at SCE, describes the information technology/operations technology (IT/OT) convergence underway at the utility as this: Software-based algorithms used to blend supervisory control and data acquisition data within distribution management system software to monitor and control grid devices at a highly granular level. The integration capacity analysis uses a “methodology that quantifies the capability of the system to integrate DERs within thermal ratings, protection system limits, and power quality and safety standards of existing equipment,” Ragsdale said.

System planners, like Ragsdale, design scenarios that model power systems and test how intermittent distributed energy traffic causes voltage and current fluctuations. DER test scenarios recreate islanding and voltage/frequency ride-through conditions that can pose risks to utility workers and grid stability. Intelligence-bearing sensors are embedded into feeders that provide visibility and situational awareness into grid activity. Applying these and related methodologies, SCE’s integrated grid project in Orange County, California, will test innovative DER system architectures before wider

deployment across its service area.

The key to DER scenario design, modeling, testing and, ultimately, deployment is real-time data and predictive analytics. Data sharing also is key to stimulate third-party market activity.

The Energy Plan for Illinois’ Future

Building on the Energy Infrastructure Modernization Act passed by the Illinois General Assembly in 2011, Senate Bill 1879 passed out of committee in early 2015. Referred to as the Energy Plan for Illinois’ Future, the bill drives grid modernization efforts that include renewable energy integration, demand response and the development of six microgrid pilot projects designed to protect critical infrastructure.

“We thank the committee for advancing Senate Bill 1879, which is a bridge to a smarter energy future,” stated ComEd Senior Vice President for Customer Operations Val Jensen, as quoted in a March 2015 Exelon news release. “This package of investments and programs will build on the foundation of the smart grid that we have been laying since the Energy Infrastructure Modernization Act was enacted in 2011.”

In addition to the six microgrid projects, ComEd’s Future Energy Plan lays the groundwork for community solar projects and electric vehicle charging station integration onto the network. Like Con Edison and SCE, ComEd is taking a methodical, cautious approach to DER integration by first assessing feeder line capacity and implementing voltage optimization measures on segments of its grid.

Competing bills submitted by various industry and stakeholder groups targeting energy in the Illinois General Assembly promise a lively debate on electricity issues.

Hawaii’s Distributed Energy Docket Plans

With a virtually unlimited and continuous supply of solar and wind energy available, Hawaii is going full steam with the integration of these renewables onto its collective island grid. Driven by two key Hawaiian Public Utility Commission (HPUC) distributed energy docket plans, Hawaiian utilities are ramping up four power purchase agreement utility-scale solar projects.

The following plans provide a useful look at current Hawaiian DER activity:

Distributed generation interconnection plan (DGIP) — In a recent order addressing the Reliability Standards Working Group report, the HPUC ordered the HECO companies to develop technical solutions and action plans to increase distributed generation interconnection capability in major capacity increments. The order specifically required the HECO companies to file DGIPs that included, at a minimum, the following general components: a distributed generation interconnection capacity analysis, an advanced DER technology utilization plan and a distribution circuit improvement implementation plan. The PUC also reiterated the preferred course of action is to conduct such planning in a transparent manner with opportunity for stakeholder participation.

Power systems improvement plans (PSIPs) — In recent orders, the commission directed the HECO companies to produce PSIPs for each utility that addresses critical power supply resource issues to accommodate large amounts of variable renewable energy, reduce power supply costs and provide significant customer rate relief. The PSIPs are to provide actionable strategies and implementation plans to expeditiously retire older, less efficient fossil generation, reduce must-run generation, increase generation flexibility, adopt new technologies and institute operational-practice changes.

In September 2015, the HPUC published a 33-page document titled, “Utility Business Models that Align with State Clean Energy Goals.”

The Takeaway

Faced with rapid technological IT/OT and DER innovation and convergence, aging centralized grid infrastructure, third-party market competition, environmental concerns and regulatory mandates, electric utilities appear destined to overhaul radically their traditional way of doing business.

Those that adapt will survive and adapt; those that attempt to maintain the status quo will find their operations engulfed by changes beyond their control. Change is occurring incrementally, allowing time for utilities to observe the trial-and-error efforts of early adopters and benefit from the development of new industry best practices.

Editor’s note: The U.S. Department of Energy (DOE) provides funding to DER infrastructure upgrades. To search DOE funding opportunity announcements, go to http://science.energy.gov/funding-opportunities. To search the database for state incentives for renewable and energy efficiency, go to www.dsireusa.org.