Energy storage has been described as the Swiss Army knife of the electric industry. Others call it the killer app of the smart grid, or they say it is the empowering technology. Whatever it is called, energy storage has proven to be a valuable multifaceted technology.

The Port of Los Angeles is installing an ABB flywheel energy storage system as part of a new microgrid. In northern England, near Manchester, the world’s first grid-scale 5-MW/15-MWh liquid-air energy storage (LAES) project was completed. In addition, GE has developed a grid-scale energy storage system, called the Reservoir, with black-start capability. And Southern California Edison, working with Fluence, is installing one of the world’s largest lithium-ion (Li-ion) battery-based energy storage systems, to improve the reliability and environmental goals of a gas-fired combined-cycle power plant.

Energy geeks are excited about the growing list of cutting-edge energy storage systems, and it is getting longer every day. Modern energy storage apparatuses are versatile, supplying power from a few kilowatts to multiple megawatts. They can supply this energy for a short time to many megawatt-hours.

When combined with other technologies, energy storage systems add value to the total system. Distributed energy resource (DER) systems with energy storage extends grid reliability to both sides of the meter. Paired with renewable energy generation, the technology makes the renewable’s electricity dispatchable. Used with demand management systems, peak loads are shifted. And, when merged with aging infrastructure, energy storage improves performance and extends the service life of equipment.

Changing Role

As the Smart Electric Power Alliance stated, “The role of energy storage can be summed up in two words: grid empowerment.” Fortunately, regulators, utilities and grid operators are beginning to see the significant role in the electrical T&D systems. According to a National Renewable Energy Laboratory (NREL) report on energy storage, understanding the economic influences, market issues and regulatory factors are critical. NREL went on to say reduced costs and improved characteristics have seen energy storage taking a larger role in the marketplace.

Energy storage moved to front-page news in 2018. A Navigant Research report examined key trends and challenges for energy storage in the grid and ancillary services (ESGAS) market. Navigant stated, “In 2018, the global ESGAS industry is projected to deploy 1220.7 MW of new capacity, growing to 29,300.5 MW by 2027.”

Meanwhile, the Energy Storage Association (ESA) estimated more than 1200 MWh of energy storage would be deployed in the U.S. in 2018 alone.

The Challenge

How can the ESGAS 2018 global projected figure jive with the ESA estimate? There really is no conflict here; it is a matter of terminology. This is an important point to make before proceeding. The global figure of 1220.7 MW is power while the ESA U.S. figure of 1200 MWh is energy. It is easy to miss this distinction, and it does not help when these terms are used interchangeably—even though power and energy definitely are not the same thing.

It is crucial to understand the difference between watts and watt-hours when discussing energy storage systems. The user must understand how these two properties combine to provide power and energy, because these characteristics are critical in defining the capability of the storage apparatuses.

Going back to basic Electricity 101, a watt is a unit of power, which is the instantaneous output of a device. Power is the rate at which energy is produced. A watt-hour is a unit of energy and a measure of the amount of work that can be performed. Therefore, energy storage systems are expressed in rated power (megawatts) and capacity (megawatt-hours).

In other words, if a light bulb needs 100 W to operate, it is rated as a 100-W light bulb. If it is on for an hour, it uses 100 Wh of energy capacity to operate. If the energy storage user wants to keep the light on for four hours, the energy storage system would be rated 100 W/400 Wh. This is a critical distinction with new regulations, policies, directives and guidelines coming from state and federal authorities, and the energy storage system must be completely defined.

Regulatory Support

Getting back to the transformational aspect of energy storage, enthusiasts are excited about what took place in 2018. A Forbes article called it, “The Energy Revolution of 2018: Energy Storage,” which summed it up nicely.

Probably the biggest event that led to the transformation was the fact regulators worldwide are supporting the technology as never before. China issued not only national-level energy storage support policies in 2017 but also regional policies, which really influenced the 2018 marketplace. According to the China Energy Storage Alliance (CNESA), the policies addressed the importance of energy storage, set goals and outlined other necessary policies to achieve those goals. By 2018, CNESA reported widespread energy storage projects in Jiangsu, Henan, Qinghai and Guangdong provinces.

In the U.S., there also was strong regulatory support when the Federal Energy Regulatory Commission (FERC) issued Orders 841 and 845 in 2018. These rules are designed to “enhance competition and promote greater efficiency in the nation’s wholesale electric markets. They will help support the resilience of the bulk power system,” according to FERC.

Order 841 removes the barriers to energy storage resources on the transmission grid and recognizes energy storage as a resource. Order 845 revises the definition of a generating facility to include electricity storage while enabling interconnections to be granted for less than the total capacity of the facility.

These two FERC orders directed regional transmission organizations and independent system operators to develop models that address all the services energy storage technology can provide. Black & Veatch’s 2018 Strategic Directions: Electric Report stated, “Observers say the new rules will open the floodgates for energy storage companies to compete in wholesale power markets.”

A paper from ABB expected the U.S. energy storage market to exceed 2 GWh in 2018, with another 1.9 GWh to be added in the rest of the world. A Brattle Group study also examined the current state and future growth potential of the U.S. electricity storage market in 2018. The Brattle Group said, “The study finds that storage market potential could grow to 50,000 MW over the next decade if storage costs continue to decline and state regulatory policies build on the recently issued FERC Order 841 to remove barriers that prevent the owners of storage resources from realizing multiple value streams.”

State regulators and policy makers also came on board with legislation supporting the deployment of energy storage technology by utilities and developers. Maryland became the first state to offer tax credits to commercial and residential customers for electrical energy storage projects.

New York’s Public Service Commission has approved initiatives to boost energy storage for its clean energy program, and Massachusetts has mandated 200 MWh of storage by 2020. With its rooftop solar mandate, California will require all new housing to include solar panels beginning in 2020. The California Energy Commission estimates nearly 75,000 new homes will be built in 2020, which will add about 222 MW of solar to the grid that year alone.

Pivotal Technology

Because of all this regulatory backing coupled with cost reductions and technology improvements, energy storage is increasing its presence in the power delivery system. For utilities, energy storage represents reduced operating revenues, increased renewable integration and decreased dependence on fossil-fuel generation. For grid operators, it means a more efficient balance between supply and demand, avoided system upgrades and improved reliability. Commercial consumers see reduced electricity bills, generated revenue and control of power disruptions. To the residential consumer, it provides the security of backup power during blackouts and the benefit of reduced electricity bills.

The versatility of energy storage technology is affecting the entire electricity value chain. If there is any doubt, look at the support manufacturers such as ABB, Fluence, GE, NEC Energy Solutions, NGK Insulators Ltd., Mitsubishi Electric Corp., S&C Electric Co., Schneider Electric SE, Siemens AG and Tesla Inc. are providing. They are delivering a variety of storage technologies such as flywheels, superconducting magnetics, flow batteries, super capacitors and other apparatuses. The suppliers also are combining energy storage technology with established smart grid technologies to make super-sophisticated energy storage systems.

Hybrid Storage

Combined technologies also are referred to as hybrid energy storage systems (HESS). These combinations are being developed by merging two or more energy storage technologies with sophisticated computer control and monitoring systems to form a single system. HESS takes advantage of the benefits of each of the shared technologies. The most promising schemes are the battery-to-generator arrangements, battery-to-battery arrangements and ultracapacitor-to-battery arrangements.

One of these schemes deployed on the Southern California Edison system combines a conventional gas-turbine generator with Li-ion battery storage and sophisticated computer software to produce a hybrid peaker plant. The GE energy storage system enables the gas turbine to idle in standby mode without using any fuel and the advanced software controls the storage device to be used as a ramping resource. In other words, when it is called to respond, the response is faster and the ramp-up is easier on the system, reducing emissions.

Another HESS scheme combines a vanadium flow battery with Li-ion batteries, taking advantage of the flow battery’s low cost and long life span with the fast response and energy density of the Li-ion batteries. According to the supplier, redT, a 180-kW/900-kWh vanadium redox battery and Li-ion 120-kW/120-kWh battery energy storage system went into service in November 2018 at Monash University’s Clayton campus in Melbourne, Australia.

The press release stated, “The flow battery will be used for 80% of the energy while the Li-ion batteries provide bursts of power-on-demand surges.” The release also stated, “This application is the first of its type globally.”

Several years ago, Duke Energy Corp. deployed a battery-ultracapacitor energy HESS on its system. The HESS combines a high-power, fast-response ultracapacitor with high-capacity aqueous (saltwater) hybrid ion batteries. The 277-kW/8-kWh ultracapacitors charge quickly and have a charge/discharge life about 10 times that of a typical old-school battery. The 100-kW/300-kWh batteries provide long-duration energy. Taken together, the HESS provides peak demand response, load shifting and support for one of Duke’s 1.2-MW photovoltaic (PV) arrays. Integrating HESS with wind and solar generating facilities has generated a great deal of interest.

Harbinger of Things to Come

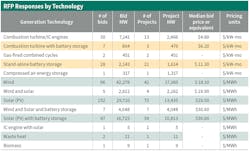

According to Vox, PacifiCorp did a study on its 22 coal plants and found 13 of them are uneconomical to operate. The Sierra Club added it would be cheaper to replace 20 of the 22 coal plants with wind. Coal advocates blustered, but Xcel Energy Inc. put out a request for power proposals asking energy developers to bid on new energy resources in 2017. The results shocked many people. Xcel received 430 bids for 238 separate projects. After the dust settled, 350 of those bids included 100 GW of renewable energy, of which 134 were for solar projects. To make the generation firm, many of the bidders included storage with their renewable bids, making them HESS schemes.

According to Carbon Tracker Initiative’s website, what shocked everyone about the Xcel Energy bids was the inclusion of storage and how cheap the storage options were. The website said, “The median bid price for wind plus storage was $21/MWh and for solar plus storage was $36/MWh.”

The summary also stated, “The median bid for wind plus storage appears to be lower than the operating cost of all the coal plants currently in Colorado, while the median solar-plus-storage bid could be lower than 74% of the operating coal capacity.”

The Xcel Energy bids are a significant milestone for energy storage applications. A report from GE Capital said it best, “The biggest shockwave has come from Arizona and Colorado, which both saw solar-plus-storage projects beat out natural gas power plants in auctions to supply new power to the grid.”

GE Capital also said, “Colorado’s January auction reverberated around the country after several developers offered projects consisting of renewables plus storage at prices below the cost of new natural gas projects in the state. Then the same thing happened in Arizona, when a solar-plus-storage plant beat out a gas-turbine project to supply power during peak periods. The results of the tender were such a success that the state regulator, the Arizona Corporation Commission, instituted a nine-month moratorium on new large natural gas plants.”

Extending Energy Storage

Results such as these show how energy storage is finding its way into all aspects of the smart grid. Getting back to the energy geeks, the U.S. Department of Energy (DOE) recently announced a new program to provide up to $30 million in funding as part of its Advanced Research Projects Agency-Energy (ARPA-E) program: Duration Addition to Electricity Storage (DAES).

DOE wants to enable ARPA-E’s DAYS project teams to develop technologies and provide long-duration energy storage systems lasting anywhere from 10 hours to approximately 100 hours. Long-term storage is one area that needs attention. The DOE stated, “Energy storage will play an increasingly critical role in the resilient grid of the future.”

The idea is the DAYS project teams will produce energy storage systems with extended discharge times, which will encourage the development of new applications. These applications provide more reliable and affordable power to the grid and even encourage greater integration of renewable generation. DOE defined the DAYS projects into two groups:

- Systems that provide daily cycling in addition to longer duration, so less cycling.

- Systems that do not provide daily cycling but can take over when daily cycling resources either are filled or depleted.

In September 2018, the DOE announced the selection of 10 DAYS projects ranging from flow batteries to thermal, chemical and underground pumped storage.

Next Steps

When all the advancements, improvements and developments taking place in energy storage technologies are considered, it is easy to see why its supporters have adopted the Swiss Army knife analogy. With increased support from regulators and policy makers, the technology is helping in the modernization of the grid.

Energy storage is being integrated into wind and solar facilities to improve the quality of the power supply. It is playing an important role in making the grid more flexible and resilient when included in distribution energy resource management systems. Furthermore, energy storage technology has been identified as a great load-leveling technology needed in the next-generation grid.

Slowly, the industry is agreeing with those calling energy storage the killer app of the smart grid because of its wide range of applications and services. Industry support is making possible new revenue streams for the energy storage applications, which is changing the T&D interface with behind-the-meter and front-of-the-meter systems. The technology is readily available and getting better all the time. While 2018 went down in the record books as an extraordinary year for energy storage, 2019 is showing signs of being even better. Energy storage is shaking up the industry.

Editors’ Note: This is the first article in a series of three articles about the latest developments in energy storage technology today. Our next article explores how solar+storage and wind+storage technologies are changing the grid and creating new business opportunities. The last article examines emerging storage trends that are redefining the power delivery system’s business plan.