To paraphrase Mark Twain, reports of the death — or even decline — of investments in electric transmission appear to be greatly exaggerated. According to a March 2015 report from the Edison Electric Institute (EEI), U.S. utilities and their partners are involved in at least 170 transmission projects, representing $47.9 billion in transmission investments through 2025. Those numbers, EEI adds, represent only a portion of the total transmission investment it anticipates coming from its members over the next 10 years.

Of those projects, EEI sees interstate transmission projects accounting for 40%, or $19.2 billion, of the total and projects supporting the integration of renewable resources representing 46%, or $22.1 billion, of the total (projects can be both types, of course). Fully, 66% of the current and planned transmission projects — an estimated value of $31.5 billion — consist of high-voltage projects of 345 kV and above.

In another 2015 study, the North American Electric Reliability Corporation (NERC) found additional transmission lines and facilities of between 230 kV and 500 kV are needed in 13 locations across the United States to meet the reliability impacts of the Environmental Protection Agency’s (EPA’s) proposed Clean Power Plan. Per NERC’s 2013 long-term reliability assessment, reliability is the driver behind 59% of new transmission line construction, followed by renewables integration driving 18% of new projects. Economic drivers such as increased electrical demand and new development, along with the need to alleviate existing congestion on transmission networks, drove 11% of new transmission construction, while 12% of projects were categorized as having other drivers.

Still Bullish

“I’m still bullish on high-voltage transmission over the next 10 years,” said Chris Underwood, manager of transmission development at Burns & McDonnell. “There are lots of trends with microgrids and storage that can complement, rather than threaten, robust high-voltage transmission systems.”

Underwood also sees the Federal Energy Regulatory Commission Order 1000 as a new transmission projects driver, particularly as it relates to the development of what he calls “competitive transmission” bid on by multiple entities. Another driver he sees is the closing of several large coal plants as a result of Section 111(b) of the EPA’s Clean Air Act, resulting in more renewable generation sources feeding into the transmission grid. The changing locations of larger centralized generation plants — be they natural gas or renewables driven — also will drive the need for more high-voltage transmission, Underwood adds.

From his vantage point as manager of strategic projects planning for regional transmission utility American Transmission Co. (ATC), Tom Dagenais agrees. “Historically, transmission has been remote and in different locations from where it is now and where it is going,” he pointed out. “It used to be at large coal plants near rail lines or near water to barge in coal. If the generation source was nuclear, it was near water for cooling. Today, we see big wind farms in the Great Plains and gas generation around big oil fields.”

The result is a transmission system “being used in ways it was not designed for,” Dagenais said.

What also is changing, Dagenais continues, is the way technology is changing electric demand and use. “On the one hand, we have energy efficiency in homes and businesses that shaves off peak usage,” he said. “But we are also right on the horizon of where we can see many more electric cars on the road. They will be plugged in at night and taking energy off the grid at night. So demand will be there, it will just be a little different.”

Utilities building new transmission also will need to plan for the modernization of both the transmission grid as well as the demands and impact of upgraded, modernized distribution systems that feature smart meters as well as distributed and even customer-owned and customer-sited generation, sometimes wheeling power back onto the grid. Heightened physical and cybersecurity threats must be factored in as well as the ability to withstand severe weather events. Examples of advanced transmission technologies already being added to new networks include fiber-optic communication, advanced conductor technology, enhanced power device monitoring and energy storage devices.

“When we forecast out five to 10 years, we try to build into our assumptions the progress that is being made in terms of distributed and renewable generation,” Dagenais said, “but we are also going to have to increase our awareness of what is out there on the system.”

Dagenais offers the example a trouble call for a downed pole. “We need to know what is connected to that line,” he said. “We used to know what was on all our lines all the time, but there are many more generators out there. That is a technical challenge and a safety concern. We have to realize the system itself has so many more players now.”

Mike Schnell, CEO of Pickett & Associates, an engineering consultant for utilities, ticks off additional technical and physical changes and challenges. “Wire and cable is constantly evolving. We are all trying to get more out of everything,” he explained. “You see different configurations of strands of conductors. You see wires annealed to run hotter. Trapezoidal strands offer a smoother surface for greater wind cooling. There are composite conductors to keep wire from sagging so much.”

Always Something, Somewhere

Drivers for new transmission can even have something of a regional flavor, says Bob Bradish, vice president for transmission grid development at American Electric Power (AEP).

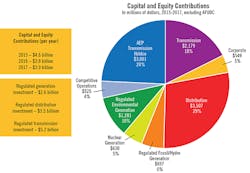

According to Bradish, AEP sees growing demand for transmission to connect shale oil gas plays to electric load centers. “We are looking at between $1.5 billion and $2 billion spend per year for the foreseeable future,” Bradish forecasted, noting just the need to upgrade and modernize networks — some of which have been in service for 40 to 50 years or more — will keep AEP busy for some time.

In a recent briefing to analysts, AEP estimated it has 40,000 miles of transmission lines in service and is allocating 71% of its capital in the 2015-2017 period to wires. AEP owns generation assets and has transmission facilities in both the Marcellus Shale (Ohio) and Eagle Ford Shale (Texas) oil plays.

Central Ohio, Bradish adds, also has recently become home to several large data centers, bringing additional electric demand. “They can represent huge electric loads when they show up here,” he said, “and they are pretty consistent.”

Another way data centers and the information age affects transmission development is through new demands on management of electric flows on the network. “The digital world is upon us,” Bradish noted. “The communications demands on our network are significant. We now have positional SCADA and a vibrant communications center that requires a lot of bandwidth to tell us just what we need and where we need it at all times. Flows are not as predictable, meaning even more reliance on data.”

According to Bradish, all transmission builders, owners and operators also must focus on the resiliency of the grid. “We have physical and cybersecurity concerns, but also natural weather events and even space weather hardening to think about,” he commented.

Mike Crowson, CEO of utilities construction contractor PLH Group Inc., concurs with the analysis of regional drivers. “We have a unit that builds transmission in the West, and we are seeing a lot of growth in renewables [generation] there,” he said. “In the Northeast, it is more grid hardening in terms of storms and weather. You go to the middle of the country, and you see it is all about aging infrastructure.”

Crowson also agrees with Bradish in terms of the marriage of new transmission with new generation sources such as shale oil field natural gas plays. PLH Group is, after all, a relatively newborn company that is a roll-up of construction contractors largely in two industries: electric transmission and gas pipelines.

“G&T needs to get done together,” Bradish argued, referring to generation and transmission. “You need to look at it from the standpoint of where is generation going? Then, how do you serve that generation? We see transmission as an enabler — of environmental policies, for markets, for customers and even with renewable portfolio standards.”

Here Come the Drones?

Andrew Stewart, president of utilities engineering consultant EDM International, calls unmanned aerial vehicles (UAVs), or drones, the “real game-changer” in terms of new transmission design, construction and maintenance. “It may still be a little while before all the regulations are in place for the use of UAVs for utilities, but it’s almost a no-brainer,” Stewart said.

The cost savings and time savings of being able to fly transmission corridors and outfit UAVs with light detection and ranging (LiDAR), Stewart adds, could result in significant

improvements in both the cost structure and time constraints of planning and building larger transmission.

But Mehmet Arslan, leader of the transmission and distribution team at Stantec, says environmental and socioeconomic factors will continue to be prominent in transmission build-outs, particularly in heavily populated urban corridors.

“When you get to areas like New York City or Los Angeles, you really can’t build a new transmission line, no matter what the demand is,” Arslan said. “People don’t want to see that line interrupting their skyline, and you won’t even get close with rights-of-way. The land is simply not available.”

That, Arslan continues, means planners will continue to be challenged to come up with ways to serve more power, and increasingly flexible power, into urban areas for years to come. He sees the answer to the challenge as more a function of a mix of distributed generation, more substations and perhaps even energy storage in and around population centers, but adds that this in and of itself may change and shape the way transmission networks deliver power to these distribution centers in large urban areas.

The Decades to Come

EEI adds a couple more drivers — or at least some additional thoughts on new transmission drivers — in its March 2015 report.

“Transmission investment facilitates the integration of new generation sources by adding robust support to the existing network, or by directly interconnecting resources, even when located far from load centers,” states EEI’s report. “Transmission also provides access to other flexible power resources and support services to complement increasing amounts of distributed generation.”

The report continues: “These transmission investments help to ensure the continued reliability of the grid in the face of power plant retirements as our nation’s mix of electric power resources change in response to new EPA rules, state and local environmental requirements, and shifts in the cost of power plant operations. Accordingly, compliance with EPA’s evolving clean air and water regulations will require a greater amount of new transmission infrastructure.”

Thus, no matter how one looks at it, it becomes quite easy to agree with Burns & McDonnell’s Chris Underwood’s bullish outlook for transmission projects and build-outs over the next several decades.

Or, as Pickett & Associates’ Mike Schnell, looking back on 30 years in the power business, puts it, “What I am seeing right now is this is a busy time. But I’ve never really seen a lull. Part of the beauty of the power line business is there is never really a lull. There just never is.”