The brave new world of Federal Energy Regulatory Commission Order 1000 is really just beginning, and it is too soon to tell just what the impact will be, according to industry participants. The order requires interregional coordination in planning and cost allocation by transmission owners, and it removes the right of first refusal for incumbent operators on new transmission projects to foster competition.

“Some things have worked well and some things not so well,” said Mike Kormos, COO of PJM Interconnection, a regional transmission organization (RTO). Today, in the early stage of implementation, many transmission owners still are not certain of the full impact of Order 1000 and may not be for the next several years.

Executives from several transmission owners shared with T&D World how Order 1000 has impacted their organizations to date and what lessons they are learning from each other.

The Impacts So Far

PJM Interconnection is pleased it was able to get nearly a dozen market-efficiency projects before the board from its recent open window on submissions. “We’ve had just one or two in the past five or six years, so this was a big increase,” Kormos noted.

Although incumbent operators retain the right of first refusal on market-efficiency projects — even under FERC 1000 — nonincumbent operators also submitted proposals. Even though the incumbent proposals ended up being selected because they were upgrades of existing lines — and thus, cheaper than proposals calling for new lines — the competition stimulated a new level of creativity, according to PJM officials. “It was a challenge to process them,” Kormos said. “It adds a lot of complexity to the process.”

While the impact of these competitive submissions may have been a harbinger of things to come, RTOs, in general, do not expect to have projects under the new competitive solicitation requirement of FERC 1000 until next year.

ISO New England, for instance, had run up a total of $7.2 billion in new infrastructure investment by June 2015, so it is in the early stages of Order 1000 implementation. “Competitive solicitations have not yet started,” explained Ellen Foley at ISO New England. “So, at this time, we do not have any hard data about how the order will affect the level of transmission investment or other elements of the planning process, such as timing or costs of the planning process, in the region.”

At Midcontinent Independent System Operator (MISO), there has not been much impact to date, says Jennifer Curran, vice president of system planning and seams coordination. “There is likely to be an impact, but we’re not quite there yet,” she explained.

With regard to the prospect of sorting through competitive solicitations, Curran said, “It’s a different role than the RTO has played. It will be an additional workload. We are starting to talk about it.”

This was the experience at Southwest Power Pool (SPP), which received more than 1,700 project submissions in 2014 under FERC 1000, compared to 150 in 2012.

“It is a lot more work in the planning process,” noted Paul Suskie, executive vice president for regulatory affairs at SPP. “It did create some time constraints.”

FERC Order 1000 is a challenge for the RTOs to implement, agrees Lisa Barton, executive vice president of AEP Transmission. “They are getting inundated in the competitive bidding,” she said. “The challenge is to make it administratively manageable.”

Just evaluating the submissions is a new process for RTOs used to dealing with incumbent transmission owners who had the right of first refusal prior to FERC 1000. “Determining who is qualified to build and how reliable the estimates are is new to them,” Barton observed.

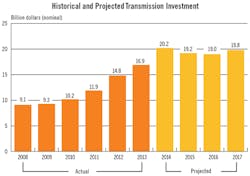

Lull in Investment

Implementation of FERC Order 1000 comes during what is something of a lull in large project investment, after the mass retirement of coal-fired plants and before the new demands of the Clean Power Plan will require large projects again. “The need for new projects is not urgent,” Barton said “It is okay to slow down.” She notes that recent transmission investment has been about smaller projects “to balance the system out.”

This generally has entailed the rebuilding of existing lines by incumbent operators and so has not tested the new provisions of Order 1000. David DesLauriers, director of federal energy regulatory affairs at Black & Veatch Management Consulting, agrees. “It really is a market in transition,” he said, which gives RTOs time to roll out implementation of FERC 1000.

“A key driver in transmission investment will be renewables,” DesLauriers noted. “The Clean Power Plan propagated by the EPA will bring new relevance to FERC 1000.”

AEP’s Barton echoes this. “The Clean Power Plan will be the big game-changer,” she said. “We have the next four or five years to figure out how to deal with that.”

Black & Veatch is consulting with several entities bidding on possible projects. “It has dramatically increased creativity and cost-effectiveness,” DesLauriers said. “It creates opportunities that didn’t exist before, for new participants and for incumbents outside their service territory.”

As a result, DesLauriers explained, “There’s a lot of jockeying for position you’d expect to see in a new market.”

AEP Transmission, the largest transmission operator in the U.S., has set up a subsidiary for competitive bidding. “The goal is to pursue projects that make sense,” Barton said. “It is a great opportunity for our engineers to sit back and focus on how we build transmission systems.”

Slow and Contentious Process

The transition is not all smooth sailing. In this early implementation stage, terms vary widely across regions, Maureen Borkowski, president of Ameren Transmission Co., warned in a presentation at the recent American Society of Civil Engineers structures conference.

“Project awards seem to focus on small projects to address localized issues,” she said in her presentation. “The process is slow and contentious.”

Antonio Smyth, president of Transource, the AEP competitive vehicle, agrees it can be a challenge to compete with local operators. “They always have a home team advantage,” he said.

But, there have been a variety of competitors, he said, including utilities and financially backed developers. Foreign companies also are expected to get involved. Iberdrola of Spain and National Grid of Britain already have active U.S. subsidiaries. Barton sees good chances for the big companies — with their resources, technology and experience — as the states understand the need to comply with Order 1000.

Scenario-based transmission planning, for instance, can help RTOs to meet each of a varying set of outcomes. “We engage in smart transmission,” Barton said of AEP. “A lot of solutions pop out.”

PJM has had to learn hard lessons from its experience with the Artificial Island project, a pre-Order 1000 project in which the solicitation process has been contentious and may be subject to further litigation. “We learned a lot about process from it,” Kormos said. “It took significantly longer to ultimately get to a resolution.”

PJM learned from the process that going all the way to the competitive solicitation mandated by Order 1000 would entail “a significant increase” in the workload and poses a challenge to keep it sustainable.

One of the balancing acts PJM has learned is how to get enough information on a project without requiring participants to invest enormously in developing a project that may not be accepted. “We don’t want them to spend a lot of money refining a proposal,” said Kormos, “but we need enough information to make a distinction among multiple submissions.”

Another challenge is how to preserve the collaborative spirit that characterized the planning between the RTO and incumbent operator in the new competitive environment. As Kormos put it, “How do you keep the benefit of competition and still keep the collaborative aspect?”

Current Focus on Resiliency

For the moment, RTOs seem to be focused largely on resiliency, AEP’s Barton says. “We continue to see an investment push for resiliency,” she noted. “We’re not seeing a lot of large projects.”

Resiliency is a driver of transmission investment at PJM, notes Kormos. The North American Electric Reliability Corporation, for instance, is concerned about the physical protection for critical substations.

“The easiest way to protect it is not to have it be critical in the first place,” Kormos explained. The challenge is how to plan a robust resiliency in a competitive and transparent environment while preserving information that is very sensitive.

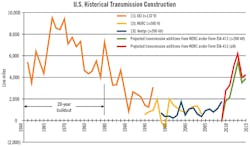

The historic driver for transmission investment — load growth — has abated somewhat, Kormos says, with growth volumes down.

DesLauriers says this is an industry trend as demand-response technology, energy efficiency and distributed energy platforms have combined to slow load growth.

“Growth in capacity in the future will be in response to changes in the resource mix,” he said. “As coal plants close down, renewables may be sited in different areas.”

That may be, but, for some system operators, it is too early to tell. “We are in the infancy of the impact of the Clean Power Plan on the resources mix,” MISO’s Curran said. “We are too new into the process to know for sure.”

The RTOs that have already engaged in the new competitive bidding, such as PJM and California ISO, are pathbreakers for the others.

“We are watching and learning,” Curran said. “We want to look at best practices as they develop.”

So aspects like what a developer’s agreement should look like and what kind of credit requirements should be in place are lessons to be learned.

Competitive solicitation is not as simple as choosing the lowest bid, of course. “Ultimately, the biggest challenge is the lumpy nature of transmission investment,” Curran said. “It is a multi-value infrastructure investment.”

SPP’s Suskie emphasizes the same point. “Cost is only one aspect of the evaluation,” he said. “Just because a bid has the lowest cost doesn’t mean the bidder will get the project.”

In fact, he says, cost carries only a 25% weight in the RTO’s overall analysis of a project.

“I think they’re making progress with it,” Barton said of the efforts of the RTOs to implement competitive solicitation as well as interregional planning and cost allocation. “In another couple of years, they could have processes in place.”

The Clock Is Ticking

Although Order 1000 has been six years in the making, DesLauriers said, “It was only completed in May.”

But the clock is ticking. “It could become a bottleneck if implementing FERC 1000 remains a problem,” Barton acknowledged.

If competitive bidding is the main administrative issue, interregional planning and, particularly, cost allocation also could create problems. MISO’s Curran is optimistic. “For regional planning and cost allocation, we already had protocols in place” before FERC 1000, she said.

SPP’s Suskie says they have been supportive of the FERC 1000 emphasis on regional planning, but acknowledges they have not dealt with issues regarding cost allocation.

“There will be a healthy level of debate,” B&V’s DesLauriers said, “especially with regard to cost allocation.” Already it is the aspect that has been the subject of the most debate in the approval processes to date, he says.

But, it is likely to vary from region to region. MISO’s Curran notes most of its projects, including those that involve interregional planning, are already covered in existing cost allocation protocols. “By and large, these are not affected by the cost allocation” in FERC 1000, she said.

Nor is she convinced this will change much even as interregional planning evolves. “A lot of hypotheses would have to be met to get to that conclusion,” Curran said.

Nonetheless, to a greater or lesser extent, change is inevitable in the wake of FERC Order 1000. “You have to accept reality as it is,” AEP’s Barton said. “It will be more competitive.” And, she emphasizes, AEP will be ready to compete.

However, only time will tell who comes out on top.

“It is too early to pick winners and losers from FERC 1000,” B&V’s DesLauriers said. “Stay tuned.”