When Edison electrified the area around his Pearl Street station, he set the stage to change the daily lives of everyone on the planet. In less than 150 years, electricity has become the most critical infrastructure for modern society to function. Electric power has become an indispensable part of everyday life. For the most part, the power-delivery systems are so well designed and operated that most people take electricity for granted — at least until the lights go out, which is why more attention has been on energy storage the past few years.

Smart grid technologies have increased the grid’s efficiency. They also have improved its resilience and addressed power-quality issues, but energy storage technology has been quietly becoming an important part of those strategies. Significant emphasis has been put on energy storage systems (ESS), making the power grid stronger and more resistant to outside forces such as extreme weather, congestion and security issues. A growing emphasis also has been placed on the regionalization of the power-delivery system to make it less vulnerable to disruptions.

Adding to these issues is the need to maintain equilibrium between generation and load while reducing system operating costs, which is quite a challenge for any technology. Unfortunately, there is no silver bullet in this battle.

“There is no one element that makes the grid more flexible or resilient than another,” said Gerhard Salge, head of technology for ABB Power Grids. “It is a combination of linking technologies; much like assembling a jigsaw puzzle, all of the pieces are needed to complete the picture.”

Change Is Here

More and more, energy storage systems are becoming the critical link. “Energy storage is providing the power grid with many additional services other than storing electricity,” Salge said. “It is being used for voltage support, frequency regulation, load leveling, power quality, peak shaving, spinning reserve and capacity firming. Selecting the right storage components for the purpose at hand requires a good understanding of the technology and the grid.

“Today’s additions, however, also must be able to grow and be flexible enough to deal with the grid today and in five, 10 or 15 years from now,” Salge said. “We must make investments future-proof, regarding flexibility, digital opportunities and upgrading potential. Understanding all of the key elements and how they fit together is key for an effective energy storage scheme or any other application.”

One way to accomplish these objectives is to add energy systems that can operate independently within the grid. The Edison Electric Institute (EEI) published the “Harnessing the Potential of Energy Storage” report in May 2017. EEI stated, “Energy storage, deployed at the appropriate scale, can be used in various ways to enhance electric company operations, optimize and support the energy grid, and enhance the customer experience.”

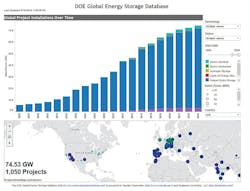

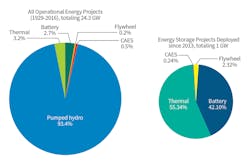

Basically, the most prevalent ESS technologies in use today are pumped storage, flywheels, supercapacitors, superconducting magnetic energy storage (SMES) and batteries. EEI’s report noted, from 2013 through 2016, batteries were the driving force in the storage market and future growth appears to be focused in the battery segment. In the U.S., the largest users of ESS are electric utilities; they account for 90% of the capacity deployed since 2013 whereas nonresidential applications account for 9%, with residential being 1% of the total.

The most popular application is the battery-based energy storage system (BESS). Sony commercialized the first lithium-ion (Li-ion) rechargeable battery in 1991, and it has changed the landscape of energy storage systems forever. Today, the industry is setting records for Li-ion battery production, which is making Li-ion batteries competitive with other energy storage technologies. General Electric (GE) reports the cost of Li-ion battery storage has dropped from more than $2000/kWh in 2008 to less than $300/kWh today. According to GE, “Technical advances will drive that price even lower, making energy storage even more appealing.”

Bloomberg New Energy Finance supported GE’s forecast and expects advancements in Li-ion battery technology to push that price down to $120/kWh by 2030. In addition, Bloomberg reported, “The global [Li-ion] battery manufacturing capacity is set to more than double by 2021, reaching 278 GWh, up from 103 GWh now.”

In addition, Bloomberg estimates that the global energy market “will double six times between 2016 and 2030” and will be led by eight countries (U.S., China, Japan, India, Germany, Australia, South Korea and U.K.) with 70% of installed capacity.

Fundamentals

Before discussing more of the trends and developments, it is important to look at the basics of energy storage. The Electric Power Research Institute (EPRI) says the main advantage of energy storage is its ability to move energy through time. Unfortunately, EPRI notes there is no way to store electricity directly, except with coils and capacitors. However, there are ways around that with indirect electrical storage. This type of storage requires electricity to be converted to some form of mechanical, chemical or kinetic energy prior to storage. It then is converted back to electricity at some point in time for use.

The electricity ESS is usually configured in either a power arrangement or an energy arrangement, so it is extremely important to select the correct storage medium. In a power scheme, the medium is designed to inject a large amount of power into the grid in a short period of time. For the energy scheme, the medium is designed to inject a steady amount of power into the grid for an extended period. Choosing the correct storage medium for a specific application requires serious study of the functional requirements of the storage system and the needs of the owner, along with the demands the ESS places on the grid.

No Free Lunch

Capital costs also are associated with an electricity ESS project. The purchase price is dependent on the type of technology selected and the power rating associated with the ESS. There also are the costs of the conversion/reconversion process. This is the power consumed (losses) in the process, which is commonly referred to as round-trip efficiencies (RTE). Think of it as the amount of power lost during the charging and discharging cycle.

This subject has launched many books, white papers and reports. So as not to get bogged down in this article, following are some industry-accepted overall efficiencies for ESS technologies:

• Pumped hydro – 65% to 80%

• Flywheels – 80% to 90%

• Batteries – 75% to 90%

• Thermal – 65% to 75%

• Compressed air – 65% to 75%.

An ESS also has additional costs associated with it, such as cycling, length of time for storage and age. As the BESS technologies mature, the industry has seen improvements in RTE and life spans. Advancements in materials and manufacturing processes have improved the economics of battery-based storage to the point where more installations are taking place.

Parts and Pieces

Getting back to BESS, Li-ion batteries have become the technology of choice for today’s requirements because of cost, which has been driven down by their extensive use in the electric vehicle (EV) industry. Li-ion batteries also are easily scalable, have rapid response, are emission free and can be located anywhere they are needed. These schemes are simple when broken down into their basic components, made up of three major segments: energy container, power conversion system and controller.

Energy containers (batteries, in this case) are really the storage technologies used to contain the electricity. The power conversion system charges and discharges the batteries. It is made up of hardware and software that provides the expected grid regulation functions with the appropriate power quality requirements. Also, during abnormal grid conditions, it supports ride-through functions.

The controller is the interface between the battery and the user. It supports specialized application functions such as frequency regulation and load shifting. All the trends and forecasts show growth and expansion in battery-based storage. Navigant Research said, “Energy storage is transitioning from a large infrastructure market of pumped hydro and underground compressed air projects to a technology-driven market, with rising scale and falling prices.”

A New Era

These changes are timely with all the growth in renewable generation (for example, solar and wind) resources finding their way to the grid. These renewable sources make delivering power reliably to the grid a bigger challenge than ever before. Wind and solar generation need something to make them dispatchable and battery systems are proving to be exactly what these resources need. Lead-acid, sodium sulfur (NaS), redox flow and Li-ion have been the leading technologies, but Li-ion battery use is capturing many industries as EVs push the technological envelope on Li-ion battery technology. It seems the Li-ion BESS is an idea whose time has come to fruition.

Interestingly, it is not just utilities and commercial applications using Li-ion storage, homeowners are taking advantage of the technology. Several manufacturers have developed products specifically for this market. Some of the better-known systems are ABB’s React, Tesla’s Powerwall and IKEA’s battery pack systems. With the expanded interest, other manufacturers such as LG Chem, Nissan, Mercedes-Benz, Panasonic Corp., Saft and sonnen Inc. are providing a wide array of Li-ion ESS to homeowners and commercial customers, too.

In addition to the push from EVs, extreme weather events like Superstorm Sandy provided another shot in the arm for electricity storage. Sandy knocked power systems off-line across the North American seaboard, causing more than 6 million customers to go without electricity in 15 states. It did not go unnoticed that microgrids provided islands of light in areas blacked out by the storm.

This idea was reinforced further when Hurricanes Harvey, Irma and Maria wreaked havoc across the Gulf Coast and Caribbean in 2017. Utilities, regulators and customers are working on strategies to strengthen the grid, and energy storage has moved to the front of the technology lineup.

Which Side of the Meter

Designers now can mix and match new technologies with problem areas, which is increasing the available solutions. No longer on the edge of the grid, these systems now are major resources. The first quarter of 2017 saw 234 MWh of capacity installed with 94% of that capacity installed in the front-of-the-meter segment. Greentech Media Research (GTM) said, “This represented more than a fiftyfold growth year over year.”

GTM also noted, “Front-of-meter deployments grew 591% year over year, boosted by a few large projects in Arizona, California and Hawaii. Companies such as ABB, Eaton, GE Energy, Panasonic, S&C Electric, Samsung, Schneider Electric and Siemens provided the technologies to the utilities.”

EEI reported that of the 22 utility-owned storage projects commissioned between 2015 and 2016, all but one was a BESS. EEI went on to say, “Lithium-ion systems represented 98% of the battery projects, making electric companies a significant contributor to the adoption of the fastest-growing energy storage technology in the United States.”

A joint report published in late 2017 by GTM and the Energy Storage Association found utilities from 14 states had included almost 2 GW of storage into their long-term integrated resource planning studies.

Gigafactories

Part of the reason for cost reductions brought about by the EV industry is the introduction of the “gigafactory” to the marketplace. The term gigafactory has a duel meaning: firstly, these factories are enormous in size (thousands of square feet), and secondly, the annual battery produced is measured in gigawatt-hours. The gigafactory promises to reduce the price of Li-ion batteries, so EVs will be more affordable for consumers.

This affordability is benefiting ESS, too, which is timely for the electric utility industry. California has mandated its utilities include utility-scale storage projects in their infrastructure and other states are sure to follow.

Tesla and Panasonic formed a partnership and developed a battery gigafactory, a facility in Sparks, Nevada, totaling about 4.9 million sq ft. They call this facility Gigafactory 1. News releases report the 4.9 million sq ft represents only about 30% of the total finished Gigafactory 1 facility. The factory’s 2018 annual battery production capacity is set to be 35 GWh.

In 2017, Tesla also opened Gigafactory 2 in Buffalo, New York, with plans to add more of these facilities in other spots around the globe. According to Bloomberg New Energy Finance, 55% of the global Li-ion battery production is based in China; that percentage is expected to increase to 65% by 2021.

Recently, China announced plans to increase its Li-ion battery capacity to more than 120 GWh by 2021. Bloomberg reported, “The massive planned increase in battery production feels similar to the Chinese manufacturing boom that radically altered the PV landscape around a decade ago.”

ABB and Northvolt AB announced a partnership to build a massive Li-ion battery factory in Sweden. It will be the largest such facility in Europe. ABB will supply robotics, automation and electrification for Northvolt’s battery factory.

Siemens and The AES Corp. announced a partnership forming Fluence Energy. Fluence is a new global energy storage company combining AES’s Advancion and Siemens’ Sietorage energy storage platforms to meet projections of market growth of about 8 GW by 2022. These developments are in line with Morgan Stanley’s prediction for the energy storage market. Its studies show the market will grow to $4 billion in the next two to three years with an ultimate value of about $30 billion.

Other manufacturers have announced plans for large factories for their battery production. Daimler’s subsidiary Deutsche Accumotive GmbH & Co. KG said it will build a new German factory designed to produce 320,000 Li-ion units. A consortium of Boston Energy & Innovation, Charge CCCV LLC, C&D Assembly Inc., Primet Precision Materials Inc. and Magnis Resources Ltd. will build a 15-GWh factory in New York. In Thailand, Energy Absolute Public Co. Ltd. also announced plans for a $2.9 billion factory in Asia that will have a Li-ion battery capacity of 50 GWh by 2020.

It Is About Balance

These battery systems are making a difference. Last year, GE used a 33-MW grid- scale BESS to black start (reboot an idle gas turbine) the Imperial Irrigation District’s El Centro Generating station in California. This was the first time a battery was used for this purpose. The modern ESS is becoming more valuable as suppliers develop more applications. Capacity firming is making intermittent renewable generation resources dispatchable, which is a valuable service. The ESS also provides voltage support, peak shaving and load leveling, which helps utilities to reduce operational costs and delay adding infrastructure.

The technology is making an impact on the grid. It has matured to the point the only limits to ESS is the user’s ability to conceive the application needed. In the past, energy storage was defined in terms of its rated power in megawatts and its capacity in megawatt-hours, but today, it is much more than the amount of energy being stored. It is the wide range of applications and services the storage system provides. The technology is available; it is maturing and it is being deployed. ♦