Building and maintaining electric distribution networks has always been a challenging task, but two trends of the last few decades appear to have upped the stakes. First, weather effects ranging from major hurricanes like Katrina and Sandy to record snowfall in Boston and raging wildfires in California attack poles, wires and equipment with powerful punches. Storms also expose a second vulnerability hidden within distribution networks: the presence of aging assets, put in place decades ago, reaching the end of their reliable, usable life.

The challenge for today’s utility is managing both the short-term and longer-term threats to power stability in distribution networks.

Batten Down the Hatches

On the storm front, storms such as Hurricane Katrina and Superstorm Sandy — and before that, hurricanes that blew across Florida and Texas in the early 2000s — resulted in both Federal Energy Regulatory Commission (FERC) mandates and consumer clamor for hardened distribution networks that could withstand bursts of bad weather.

Naturally, Florida was an early proving ground, and, after back-to-back hurricane seasons took down portions of Florida’s largest distribution networks five times in two years in the early 2000s, the Sunshine state’s utilities went to work looking at ways to harden networks to withstand high wind, torrential rain and flooding. One of the first places they looked was underground.

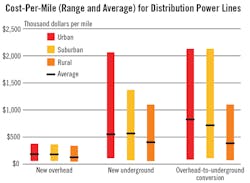

“After major storms, hurricanes, linear winds, what have you, there is always a tendency to say let’s just put everything underground,” explained Richard Brown, practice director with utilities engineering consultancy Exponent, which directed an underground conversion study for Florida electric utilities in the late 2000s. “But putting everything underground is not only expensive, there are other things we can do to avoid damage and make restoration faster.”

Among those things, Brown lists examining critical distribution circuits and focusing on bringing specific lines up to extreme wind-speed land ratings. Critical feeders serving the most important loads needed in the wake of a storm should be the first target for upgrades, he says. Along with obvious candidates such as hospitals, police, fire and emergency services, Brown cites feeds to local gas stations, grocery stores, pharmacies and home improvement stores as critical.

“If your house or business is out of power and going to be out of power for hours or days, you still have needs to get gas, food and medical supplies,” he noted.

A rush underground, Brown adds, ignores the fact an underground conduit damaged by a storm surge is likely to be harder to diagnose and repair than a downed pole and wires that are both visible and more easily accessible aboveground.

Moving up the East Coast, Brown says Hurricane Sandy taught utilities a different lesson on storm hardening. Sandy, he says, was a storm whose major impact was flooding, in particular sending several feet of saltwater into substations on Long Island and Manhattan. The response, he says, was to flood-proof, or at least flood-harden, substations. Smaller-footprint substations can be built to be on raised platforms, and substations also can be surrounded by flood walls, dirt embankments and even sandbags. Critical components of substations such as a control house can be elevated to clear a reasonable floodplain.

Lee Willis, former vice president for technology with Quanta Technology, adds that Consolidated Edison of New York has cranes and equipment on call in Manhattan to lift sections of substations up to 10 ft above grade as needed. “They’ve also built some honking big dams to keep the water out,” Willis commented.

With substations, Willis adds, utilities should look at each substation and try to figure out what could go wrong in a storm. Flooding is one issue, but another might be high wind. “The substation may already have a firewall, but if you raise it 2 ft, maybe blowing debris goes over the critical equipment,” he explained.

Willis says storm hardening should be approached with two complementary goals in mind: system resiliency during a storm and expedient restoration once the storm has passed. The first, he says, can be approached through system design, by identifying more switchable paths or by deliberately building a weak link in a conductor that acts as something of a breaker to isolate lines during a storm.

Restoration after a storm, Willis adds, can be sped by consistent and meticulous vegetation management, particularly around critical circuits, as well as system design that puts critical distribution components within easy reach.

“From a mechanical standpoint, you may want to add extra guys to the most critical poles, but also make sure you put those poles on or near streets where bucket trucks can get to them,” he cautioned.

Storm hardening also should be targeted to local conditions, Willis says. “If you want to storm harden in Nashville, you may need different anchoring systems than you would use in the sands along the beach in North Carolina,” he added.

Time Spares No One

While some distribution networks may avoid storm damage, none can escape the clutches of Father Time. Over the years of use, towers, cables and network components wear and deteriorate, whether aboveground or buried in the earth, whether inside shelters or exposed to the elements.

In fact, and somewhat ironically, a storm-hardening strategy that relies primarily or exclusively on burying distribution underground can have the unintended effect of putting aging assets out of sight and making them harder to both diagnose and repair. Another issue undergrounding brings up is having to wrestle with complementary services — cable television and wired Internet — that ride the utility’s distribution poles.

It may not be possible or feasible to bury complementary services alongside electrical conduit, and even if it is, when something goes wrong with a cable feed, which company has the right, resources and responsibility to dig up an underground conduit to fix it — the utility or the cable company?

Aboveground, utilities can more easily see what is deteriorating, but that does not always make things easier to fix. Gary Huffman, program manager for T&D at Burns & McDonnell, has spent 23 years with Southern California Edison. He says utilities face pressure to stay ahead of the ever-increasing need to both replace aging assets and incorporate new distribution technologies.

“Most big utilities have a deteriorated-pole replacement program,” said Huffman. “So that’s one part of it. But at the same time that they are aggressively replacing thousands of poles, our customers are looking at new distribution technologies, like battery storage and microprocessor-controlled relays. In California, while utilities are busy replacing old oil field equipment, they’re also adding automated metering and trying to get ready for the next generation of technology.”

Huffman says increasing demand for electricity also means utilities must be prepared for cutovers to larger-voltage distribution systems. “With all the new electronic devices and bigger homes, we are finding that 4 kV is at its operational limits,” Huffman noted. “Utilities are now looking at 13 kV or 16 kV.”

A 4-kV cutover might mean a total changeout in distribution equipment and technology. “Pretty much everything has to go,” Huffman declared. “Poles have to get taller, you have bigger conductors, wires might need to be replaced.”

On the positive side, cutovers can help a utility to upgrade existing distribution equipment to meet current wind and ice loading codes. “When you do replacements and cutovers, you are improving storm resiliency at the same time,” Huffman noted.

Mehmet Arslan, leader of the T&D team at Stantec, discusses another side of distribution asset aging. “There is visual aging, like equipment being in the sun too long or wind and moisture damage,” Arslan said. “But, there is also nonvisual aging — the ‘design aging’ of these structures. In the past decades, there have been changes in load scopes. We end up having much larger wind forces on our structures than they were originally designed for.”

Andrew Stewart, CEO of utilities engineering consultancy EDM International, offers another out-of-sight aging asset concern. “People are looking at things like wood-pole deterioration and replacement,” Stewart said, “but we are also seeing more activity addressing subgrade corrosion issues.”

Buried assets such as cable, conduit, and concrete pole or substation foundations, Stewart explains, are all subject to both environmental and temporal degradation. “In benign climates, it may not be as big an issue, but in aggressive climates, in particular, every component is subject to deterioration,” he warned.

Stewart also recommends looking at storm hardening and the replacement of aging assets, if at all possible, as complementary pieces of a distribution upgrade strategy.

He notes that in Southern California, the hardening of distribution networks in wildfire zones usually involves replacing older lower-to-the-ground transformers and wires with newer higher-strung, more fire-resistant materials and equipment. Sometimes the upgrade can be as simple as replacing wood poles with steel.

But short of putting everything underground — at significant cost and incorporating out-of-sight corrosion issues — Stewart sees distribution networks as almost always having at least some vulnerability. “It is pretty difficult to design an entire distribution system that can stop a tree from falling on it,” he said.

Cost, Cost and More Cost

Of course, one of the biggest obstacles utilities face when doing distribution upgrades is sheer cost and scale. “It is purely an economic issue,” Willis claimed. “Time takes its toll, poor maintenance takes its toll, and the civil facilities are the greatest cost of all. You have to replace duct and tear up streets, go over and under bridges, and replace assets in crowded urban centers.” The money side of distribution upgrades “becomes staggering,” Willis said.

Brown says recent and current efforts in Virginia are trying to ease the burden, somewhat, by letting utilities recover undergrounding costs through a rate rider without having to go before the public utility commission (PUC) for a rate case. In Oklahoma, OG&E was granted a specialty regulatory rider into its rate base to fund system hardening and asset replacement on 103 distribution circuits over the past several years.

Huffman says the Indiana Utility Regulatory Commission passed a statute in 2013 called P-DISC, encouraging utilities to invest in their distribution systems and providing a rate of return on those investments. “As a result, you have seen companies like NIPSCO and Duke Indiana pursuing those capital investments,” he noted.

And Mark Crowson, CEO of utilities industry construction contractor PLH Group Inc., says that while grid hardening and replacing assets is “all I ever hear about today,” the stark reality for many utilities is they simply cannot afford to do nearly as much as they would like. “Putting everything underground is always the first choice,” Crowson said. "Then people get sticker shock, and on your second cut, you say, ‘Well, here is what really needs to go underground and here is what doesn’t.’ What you end up with is a blend.”

Crowson offers one more ray of hope for utilities, though. “Any time you have major storm like a Katrina or a Sandy, and you go to the politicians and the commissioners, suddenly you have some political will behind it to say let’s see what is going on here.

You follow a major storm with a request for a rate case, and you will get a much better hearing,” he explained.

Huffman concurs with Crowson, offering that, while most utilities know their distribution networks could use upgrading and hardening, more often than not, their wish list quickly gets pared down to a critical-needs list — and even at that point they are challenged to cost-justify upgrades.

“Distribution upgrades, for either storm hardening or asset replacement, even for the implementation of distributed generation and advanced technologies, are going to have to be included in rates,” Huffman concluded. “We are going to be constrained by dollars until consumers and PUCs can determine how much utilities can afford to do. We can offset some costs with retiring older equipment with more efficient, newer technology, and we can give customers some credit for energy efficiencies. But, in order for this to happen on a larger scale, utilities are going to have to monetize it, and customers will have to determine how much they want to pay for it.”